40 find the coupon rate of a bond

5-Year T-Note Overview - CME Group 5-Year US Treasury futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR ... Difference between YTM and Coupon Rates - Difference Betweenz The coupon rate is generally fixed for the life of the bond. The payments are usually made semi-annually. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then the bond issuer will pay the bondholder $50 per year in interest ($1,000 x 0.05 = $50). Coupon rates are set by the issuer at the time of issuance and generally ...

Russia says it fulfilled obligations on Eurobond coupons ... The finance ministry said it channelled $71.25 million on coupon payout for dollar-denominated Eurobonds maturing in 2026 and 26.5 million euros ($28 million) on papers due in 2036 . Register now ...

Find the coupon rate of a bond

Sri Lanka to default on debt, no money for fuel, minister ... Sri Lanka is expected to be placed into default by rating agencies on Wednesday after the non-payment of coupons on two of its sovereign bonds, while the energy minister said the country had run ... A newly issued bond pays its coupons once a year. Its ... A newly issued bond pays its coupons once a year. Its coupon rate is 4.8%, its maturity is 20 years, and its yield to maturity is 7.8%. a. Find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 6.8% by the end of the year. (Do not round intermediate calculations. India 10 Years Bond - Historical Data Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. India 10 Years Government Bond Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column contains prices at the current market yield.

Find the coupon rate of a bond. AT&T Inc. Commences Tender Offers for 63 Series of Notes dallas, may 16, 2022 -- ( business wire )-- at&t inc. (nyse: t) ("at&t") announced today offers to purchase for cash (i) any and all of the 54 series of outstanding notes described below under... I Need Accounting Help Asap! | Dark Essays Minneapolis Health System has bonds outstanding that have four years remaining to maturity, a coupon interest rate of 9% paid annually and a $1,000 par value. a. What is the yield to maturity on the issue if the current market price is $829? b. If the current market price is $1,104 Daily Treasury Yield Curve Rates - YCharts Japan Government Bonds Interest Rates: May 17 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: May 17 2022, 19:50 EDT: Euro Short-Term Rate: May 18 2022, 02:00 EDT: Spain Interest Rates: May 18 2022, 04:00 EDT: European Long Term Interest Rates: May 18 2022, 04:00 EDT: Sterling Overnight Index Average (SONIA) May 18 2022, 04:00 EDT Municipal Bonds | Tax-Advantaged Strategies | PIMCO Based on risk-adjusted returns as of 03/31/2022. One of the first municipal interval funds in the industry, the PIMCO Flexible Municipal Income Fund ("MuniFlex") aims to deliver higher after-tax yield than traditional municipal strategies. Overall Morningstar Rating™ among 42 funds.

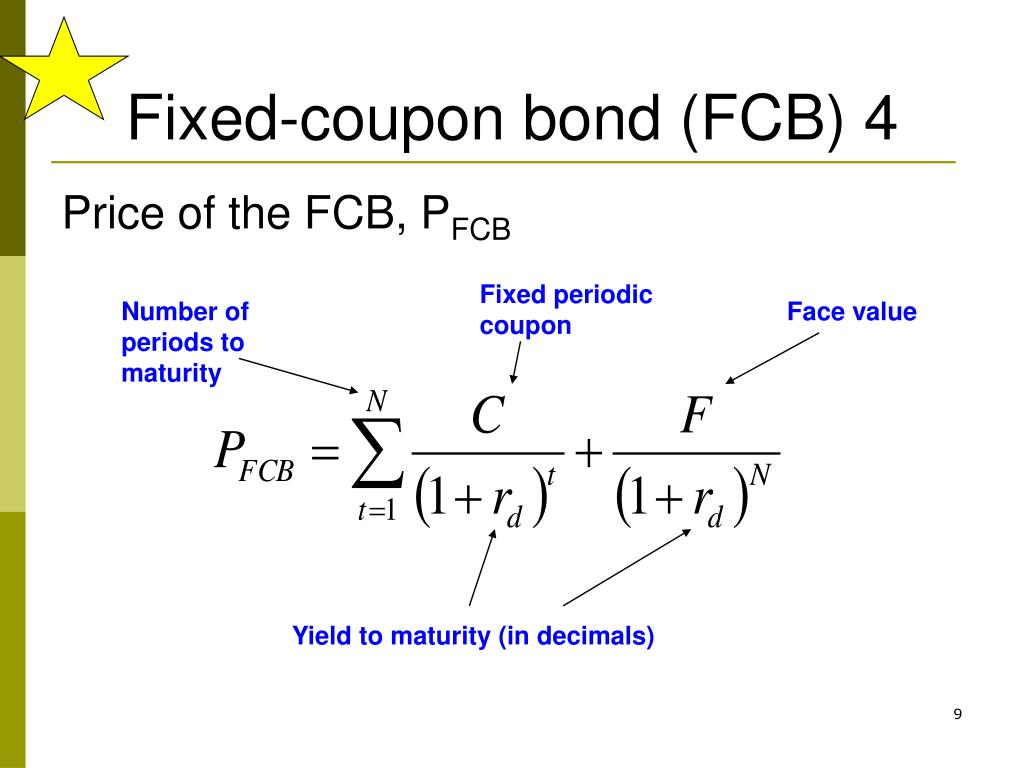

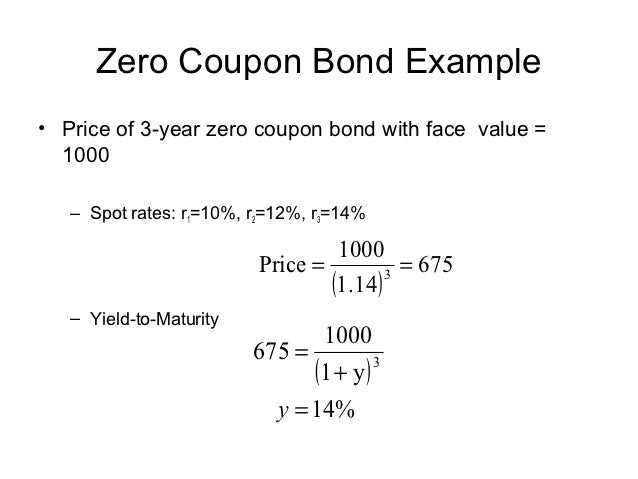

Calculate the fair present values of the following bonds Calculate the fair present values of the following bonds, all of which pay interest semiannually, have a face value of $1,000, have 10 years remaining to maturity, and have a required rate of return of 15.5 percent. a. The bond has a 7.2 percent coupon rate. (Do not round intermediate calculations. US Treasury Zero-Coupon Yield Curve Refreshed 2 hours ago, on 16 May 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities. 1- An investor is considering a bond that currently sells ... 1- An investor is considering a bond that currently sells at a discount ($953) to the face value of $1,000. The coupon rate is 9.25% paid annually. Russia Default Risk Surges as US Set to End Key Bond Waiver An economic crisis unprecedented in the country's history since independence in 1948 has led to a critical shortage of foreign exchange, that saw it miss two coupon payments on sovereign bonds on ...

iShares 1-3 Year Treasury Bond ETF | SHY iShares 1-3 Year Treasury Bond ETF ($) The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted. The performance quoted represents past performance and does not guarantee future results. NETFLIX INC.DL-NOTES 2015(15/25) Bond | Markets Insider The Netflix Inc.-Bond has a maturity date of 2/15/2025 and offers a coupon of 5.8750%. The payment of the coupon will take place 2.0 times per biannual on the 15.10.. At the current price of 104 ... Yield To Maturity Vs. Coupon Rate: What's The Difference? Coupon charges are mounted when the federal government or firm points the bond. The coupon charge is the yearly quantity of curiosity that shall be paid based mostly on the face or par worth of the safety. How to Calculate Coupon Rate . Suppose you buy an IBM Corp. bond with a $1,000 face worth that's issued with semiannual funds of $10 every ... Adele Company purchased a bond which carries a coupon rate ... The carrying amount of the investment. Adele Company purchased a bond which carries a coupon rate of10%. The bond is a 5 million 3 year bond. The bond was purchased inJan XXXXXXXXXXto yield 12%. The interest is payable annually and theprincipal is to be repaid on maturity date. The bond was sold on July 1 2021 @ 98%.

Ultra 10-Year U.S. Treasury Note Quotes - CME Group Ultra 10-Year U.S. Treasury Note Futures - Quotes. Last Updated 14 Apr 2022 07:17:17 PM CT. Market data is delayed by at least 10 minutes. All market data contained within the CME Group website should be considered as a reference only and should not be used as validation against, nor as a complement to, real-time market data feeds.

How Attractive are the Astrea 7 PE Bonds? (Indicative ... The bond coupon or the current yield to maturity is indicative during the issue. Most likely, when the bond starts trading, the yield to maturity will be much lower. This is because past Astrea bond issues have been so popular as the retail sees this like a safe bond but yielding more than 4%.

[Solved] A 75,000, at 11% bonds pays coupon semi-annually redeemable at 90,000 pesos on January ...

Zambia Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Zambia Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

VERIZON COMMUNICATIONS INC.DL-NOTES 2019(19/29) Bond ... The Verizon Communications Inc.-Bond has a maturity date of 2/8/2029 and offers a coupon of 3.8750%. The payment of the coupon will take place 2.0 times per biannual on the 08.08..

Modified Duration | Brilliant Math & Science Wiki By substituting in the formula for Modified Duration, we get that 4.445 = - \frac {1} {1100} \times \frac { \Delta P } { 1 \% }. 4.445 = −11001 × 1%ΔP . This gives us \Delta P = - 4.445 \times 1100 \times 1 \% = - \$48.895 ΔP = −4.445×1100×1% = −$48.895. Thus, the new price would be P + \Delta P = \$1100 - \$48.895 = \$1051.105.

Malta Government Stocks - Central ... - Central Bank of Malta Up to 2003, yields were computed according to the Actual/365 day convention. Since then, yields started to be computed on an Actual/Actual basis. As the coupon rate on MGS is paid on a six-monthly basis, the Yield-to-Maturity is not strictly comparable with that of other bonds whose coupon rate is paid annually.

T2023-S$ Temasek Bond - Temasek Current yield: relating annual coupon of the bond to its market price. If the market price of the T2023-S$ Temasek Bond is S$0.980, its current yield would be approximately equal to [S$27 / (S$0.980 x 1,000)] x 100% = 2.76%, which is greater than the coupon rate of 2.70%.

Post a Comment for "40 find the coupon rate of a bond"