42 yield to maturity of coupon bond

iShares® iBonds® Dec 2025 Term Corporate ETF | IBDQ Standard Deviation (3y) as of Apr 30, 2022 5.54% Average Yield to Maturity as of Jun 09, 2022 3.85% Weighted Avg Coupon as of Jun 09, 2022 3.30 Weighted Avg Maturity as of Jun 09, 2022 2.93 yrs Effective Duration as of Jun 09, 2022 2.75 yrs Convexity as of Jun 09, 2022 0.06 Option Adjusted Spread as of Jun 09, 2022 83.08 bps Yield to Maturity (YTM) Definition - Investopedia

AGG | ETF Snapshot - Fidelity The investment seeks to track the investment results of the Bloomberg U.S. Aggregate Bond Index. The index measures the performance of the total U.S. investment-grade bond market. The fund generally invests at least 90% of its net assets in component securities of its underlying index and in investments that have economic characteristics that ...

Yield to maturity of coupon bond

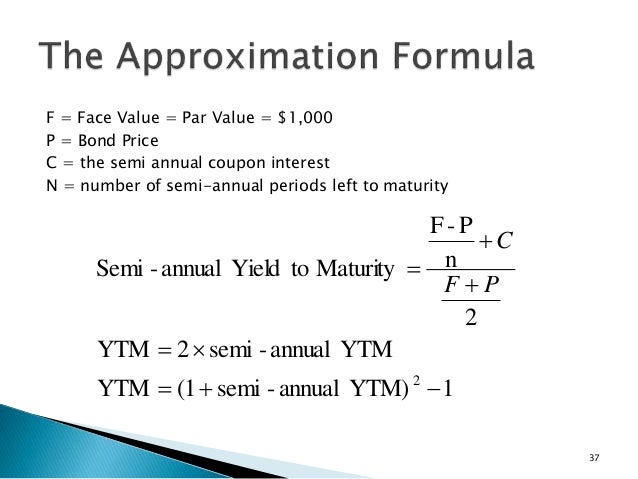

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ...What Is the Difference Between Coupon Rate and Yield?What Happens If the Yield to Maturity Is Greater Than the Coupon Rate? U.S. Treasury Bond Overview - CME Group Face value at maturity of $100,000. Price Quotation. Points and fractions of points with par on the basis of 100 points. ... U.S. Treasury Bond Yield Curve Analytics ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund ... Interest Rates Expectations and Flow Dynamics in High Yield Corporate ... As a result, as interest rates rise, coupon rates also increase, benefiting floating rate BLs. In contrast, HYBs typically have fixed coupons, becoming a less attractive asset for investors in a rising interest rate environment. 6 Conversely, HY bonds will benefit from declining interest rates and periods of easing monetary policy. Second ...

Yield to maturity of coupon bond. APPLE INC.DL-NOTES 2017(17/27) Bond | Markets Insider The Apple Inc.-Bond has a maturity date of 6/20/2027 and offers a coupon of 3.0000%. The payment of the coupon will take place 2.0 times per biannual on the 20.12.. At the current price of 96.84 ... Who's afraid of the flattening bond yield curve? The yield to maturity (YTM) of a bond is the total rate of return on a bond, assuming that it is held until its maturity. This rate includes the principal payment, as well as regular coupon payments and takes into account the market price of the bond. While the coupon rate remains fixed, the YTM changes with the bond's market price. All the 21 Types of Bonds | General Features and Valuation | eFM It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. These are also called discount bonds or deep discount bonds if they are for a longer tenor. Deferred Coupon Bonds iShares® iBonds® Dec 2023 Term Treasury ETF | IBTD - BlackRock The Average Yield to Maturity shown is the weighted average yield to maturity of the individual bonds. During the final year of the fund's life, the underlying bonds will mature and the proceeds will be held in cash equivalents until the liquidation of the fund. ... Unlike a direct investment in a bond that has a level coupon payment and a ...

Bond Yield | Definition | Finance Strategists $50 is 4.5% of $1100, so the yield to the new investor is only 4.5%. If the same bond were to be sold for $900, the yield would be 5.5%. Therefore, since the maturity date and coupon rate remain constant, the yield only changes based on the market price for a given bond. WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 124 ... EGP T-Bonds EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 5. Auction date. 13/06/2022. Issue date. 14/06/2022. Maturity Date. 05/04/2027. iShares® iBonds® Dec 2027 Term Corporate ETF | IBDS The Average Yield to Maturity shown is the weighted average yield to maturity of the individual bonds. During the final year of the fund's life, the underlying bonds will mature and the proceeds will be held in cash equivalents until the liquidation of the fund. ... Unlike a direct investment in a bond that has a level coupon payment and a ...

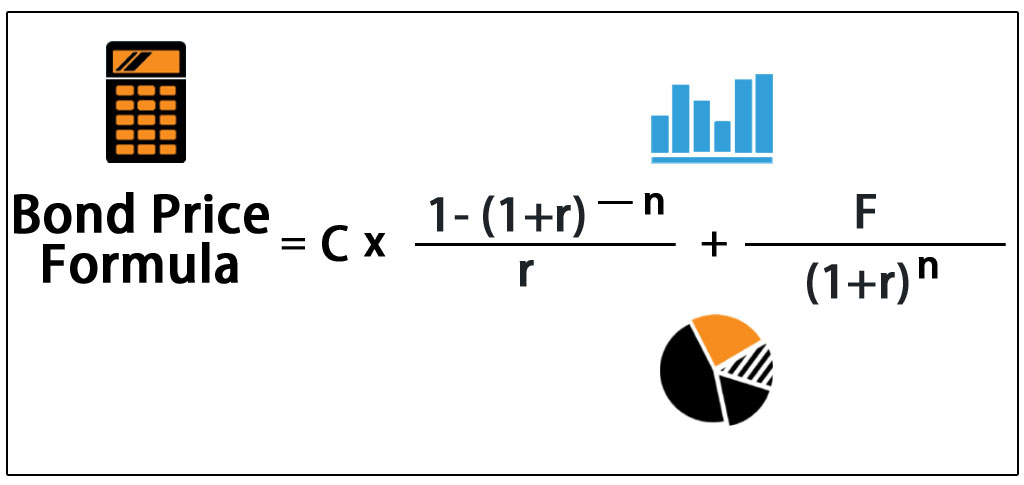

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.448% yield. 10 Years vs 2 Years bond spread is 2.3 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United States credit rating is AA+, according to Standard & Poor's agency. FXNAX Performance & Stats | Fidelity® US Bond Index Basic Info. Investment Strategy. The investment seeks to provide investment results that correspond to the aggregate price and interest performance of the debt securities in the Bloomberg U.S. Aggregate Bond Index. The fund normally invests at least 80% of the fund's assets in bonds included in the Bloomberg U.S. Aggregate Bond Index. Why Does The Bond Yield Curve Matter? - SG Investor Hub The yield to maturity (YTM) of a bond is the total rate of return on a bond, assuming that it is held until its maturity. This rate includes the principal payment, as well as regular coupon payments and takes into account the market price of the bond. While the coupon rate remains fixed, the YTM changes with the bond's market price. How Do I Determine the Fair Value of a Bond? (with picture) To illustrate, is helps to consider a bond that has $1,000 USD par value, pays $100 coupon per year, with a 9% yield or discount rate, and will mature in three years. P = 100/ (1+0.09) + 100/ (1+0.09)^2 + 100/ (1+0.09)^3 + 1000/ (1+0.09)^3, which is equal to the fair value of $1025.31 USD.

iShares 7-10 Year Treasury Bond ETF: On A Downward Rally During the past decade, average yield ranged mostly between 1 percent to 2 percent. Since 2021 the yield fell below 1 percent. That's not surprising because the weighted coupon earned on the...

Attention investors: TIPS are now a viable, attractive alternative to I ... UPDATE: Real yields surged again Tuesday, with the 5-year rising to 0.73% and 10-year to 0.89%. These are some crazy numbers. The 5-year real yield surged 46 basis points in two days. The 10-year TIPS real yield was up 40 basis points.

BondBloxx USD High Yield Bond Energy Sector ETF - BondBloxx® ETF Yield to Maturity: The discount rate that equates the present value of a bond's cash flows with its market price (including accrued interest). The Fund Average Yield to Maturity is the weighted average of the fund's individual bond holding yields based on Net Asset Value ('NAV'). The measure does not include fees and expenses.

This Is Why You Should Ditch Your Bond Funds And Buy Some Bonds Instead At that time, a 6-month U.S. Treasury bill had a 0.2% yield, thus yielding 4% better performance (or, roughly, 8% annualized) than the supposedly ultra-conservative short-term fund. SHY is unlikely...

Invest in Public Bond Issue or Bond IPO | Indiabonds 10,00,000 depending on product type and underlying bonds. Maturity Date - ... The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the ...

Lawrence McDonald on Twitter: ".@saylor says... "So we feel like we ... Sign up. See new Tweets

Treasury Bonds: Are They a Good Retirement Investment? Suppose a 30-year bond has a coupon rate of 4.25%. Investors think this bond is actually worth 4.35% — this is its yield to maturity. In order for the investor to make 4.35% on the bond, they have...

Egypt Government Bonds - Yields Curve The Egypt 10Y Government Bond has a 17.405% yield. 10 Years vs 2 Years bond spread is 261.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 11.25% (last modification in May 2022). The Egypt credit rating is B, according to Standard & Poor's agency.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "42 yield to maturity of coupon bond"