41 yield to maturity coupon bond

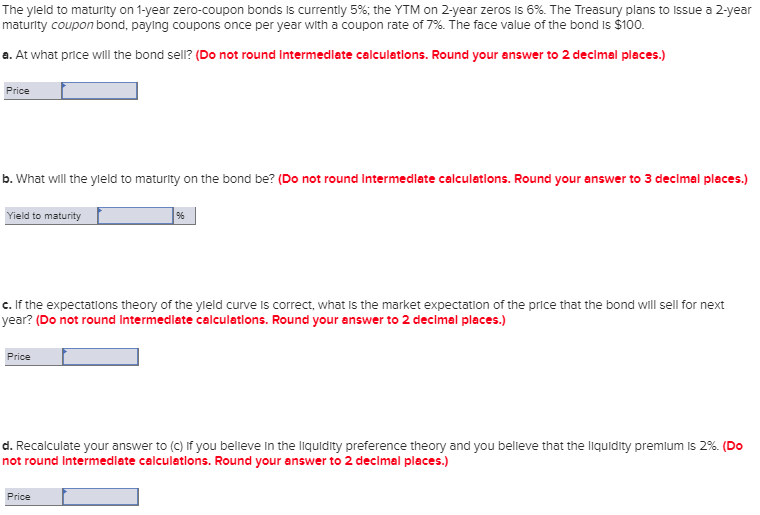

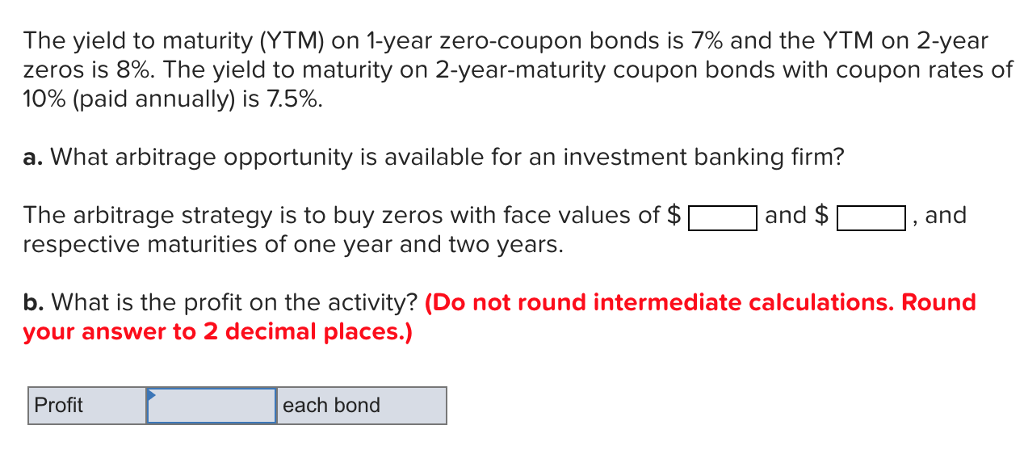

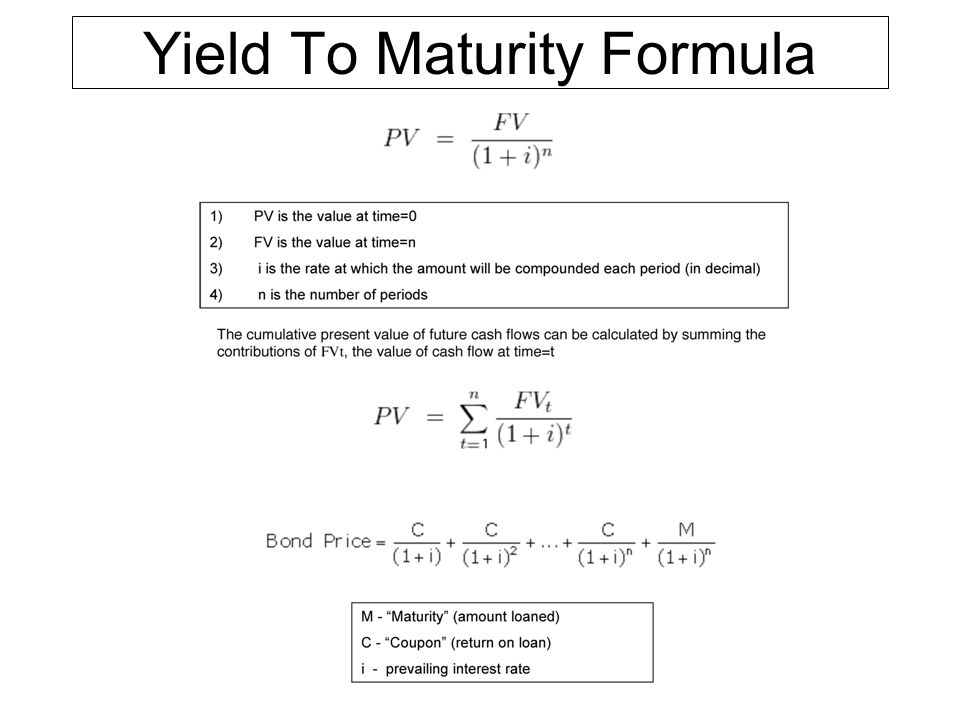

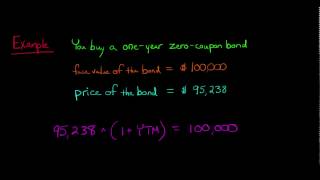

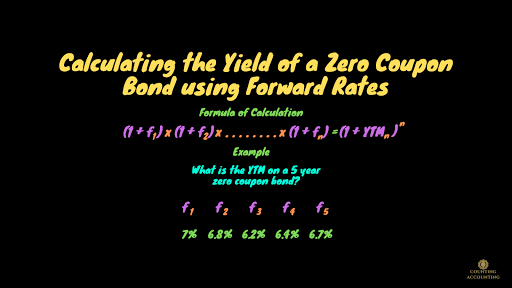

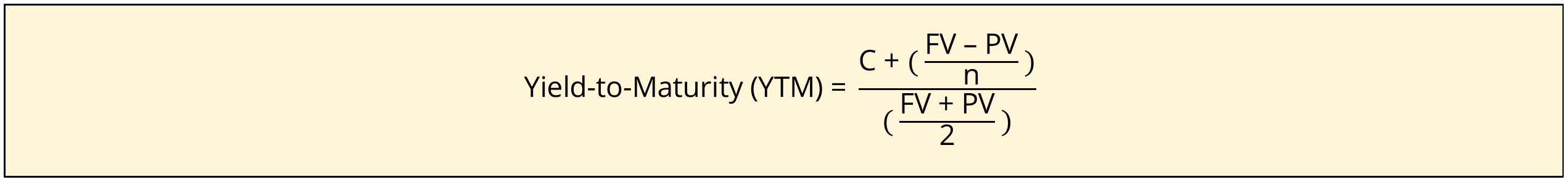

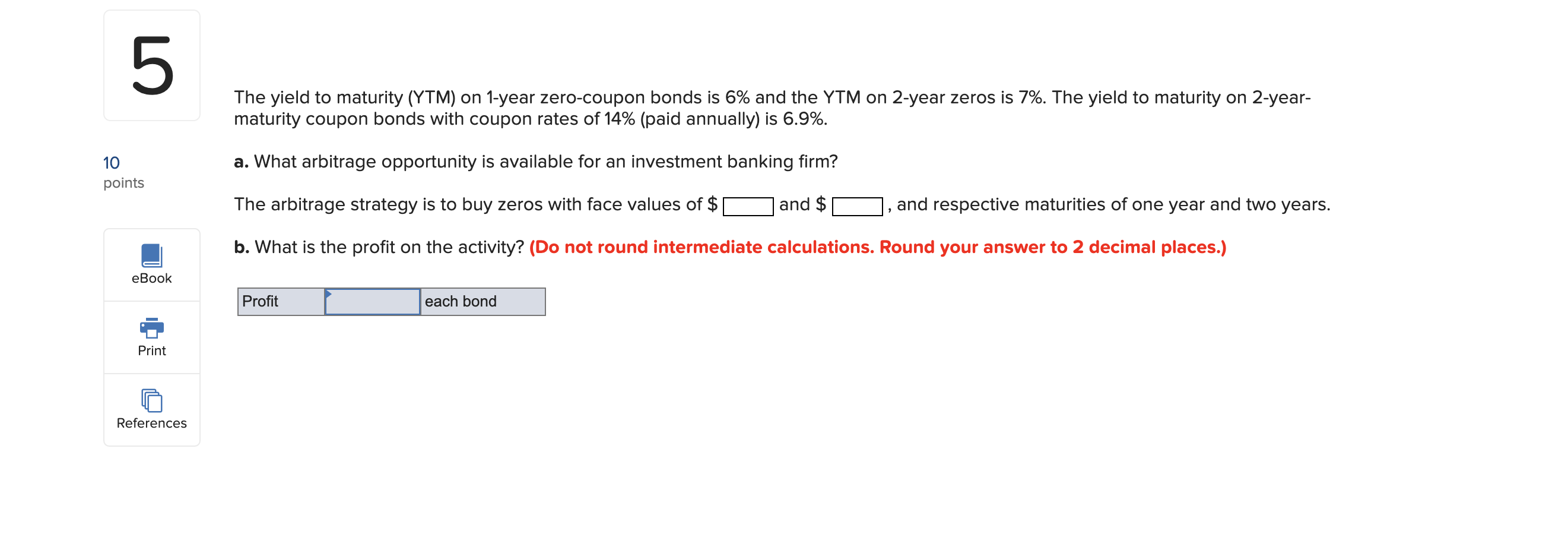

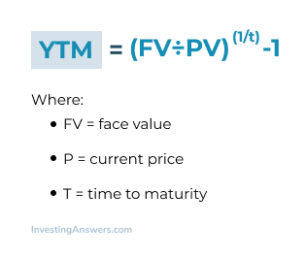

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

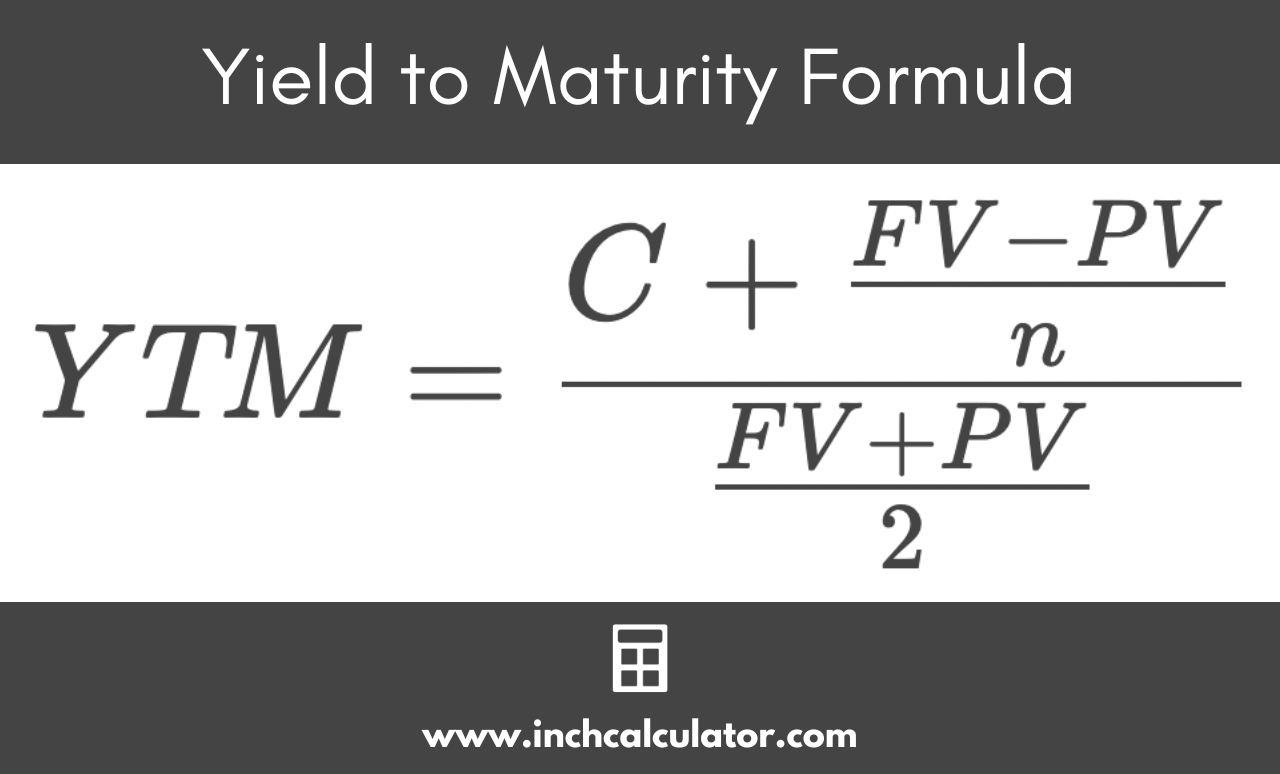

Yield to Maturity (YTM): Formula, Meaning & Calculation But to simplify this, let us first consider what YTM means with respect to an individual bond. In the case of a Bond, YTM is defined as the total rate of return ...

Yield to maturity coupon bond

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics. When a bond is issued, the issuing ... Bond maturity value calculator - qbydu.zsaluzia.info BOND CALCULATOR . This calculator is designed to help you calculate bond prices and yields. Simply enter 4 of the 5 values for your bond then click the relevant button to calculate the missing value . Click here to try our other Investment Calculators . Bond Price Field - The Price of the bond is displayed or entered in this field.

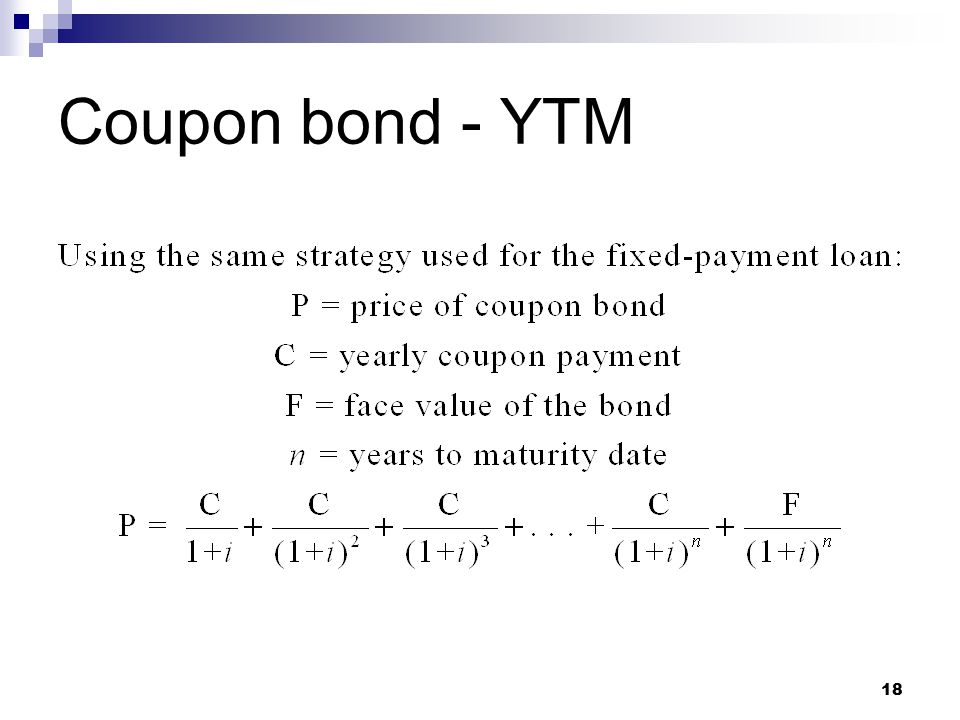

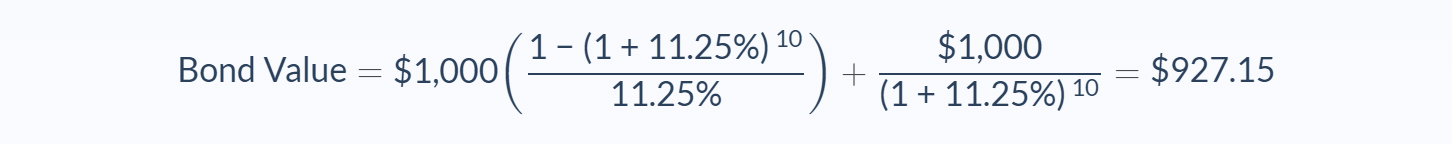

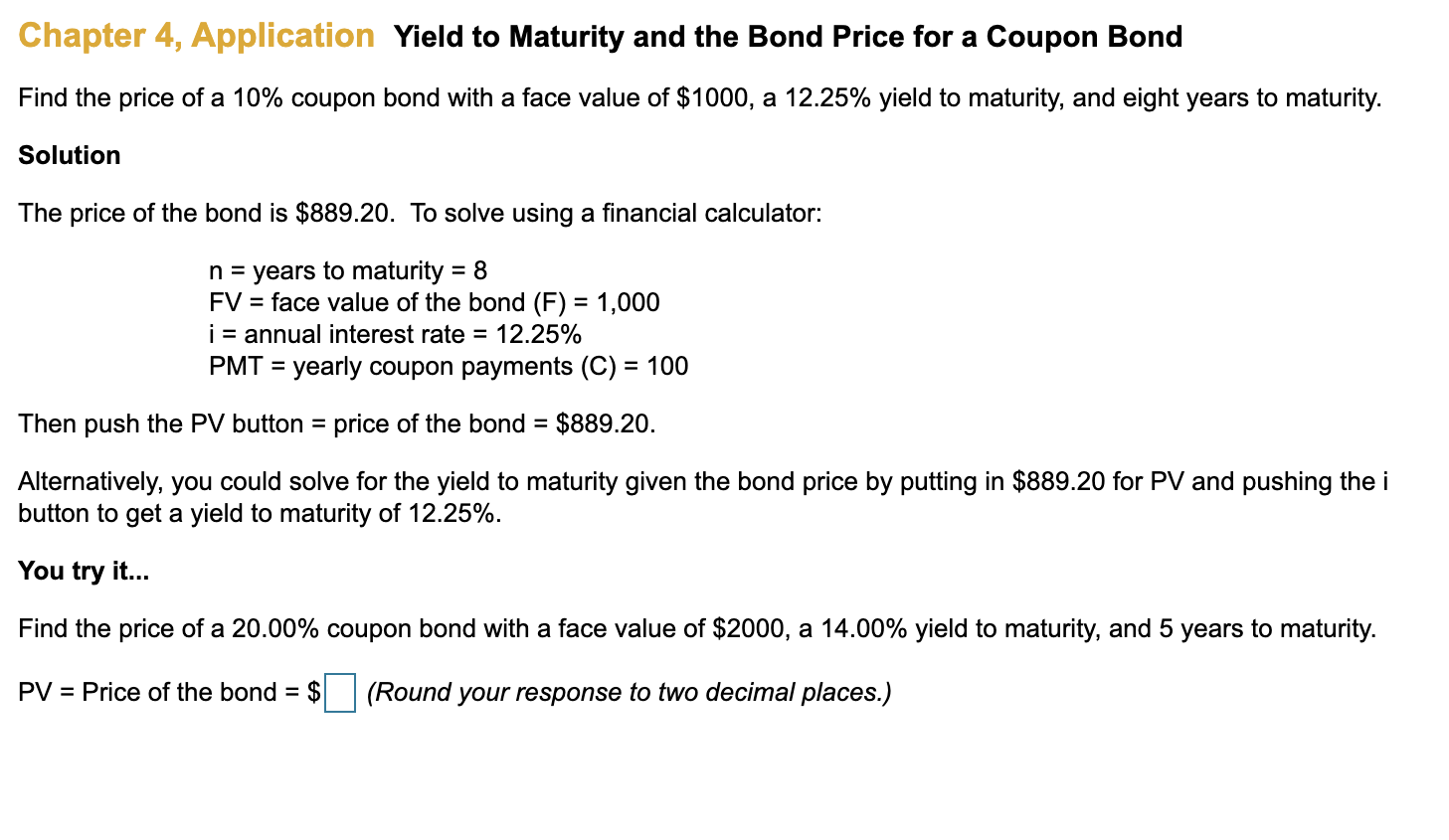

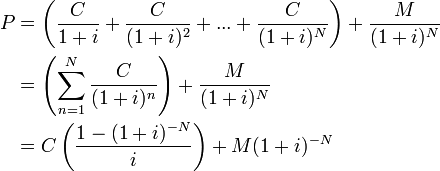

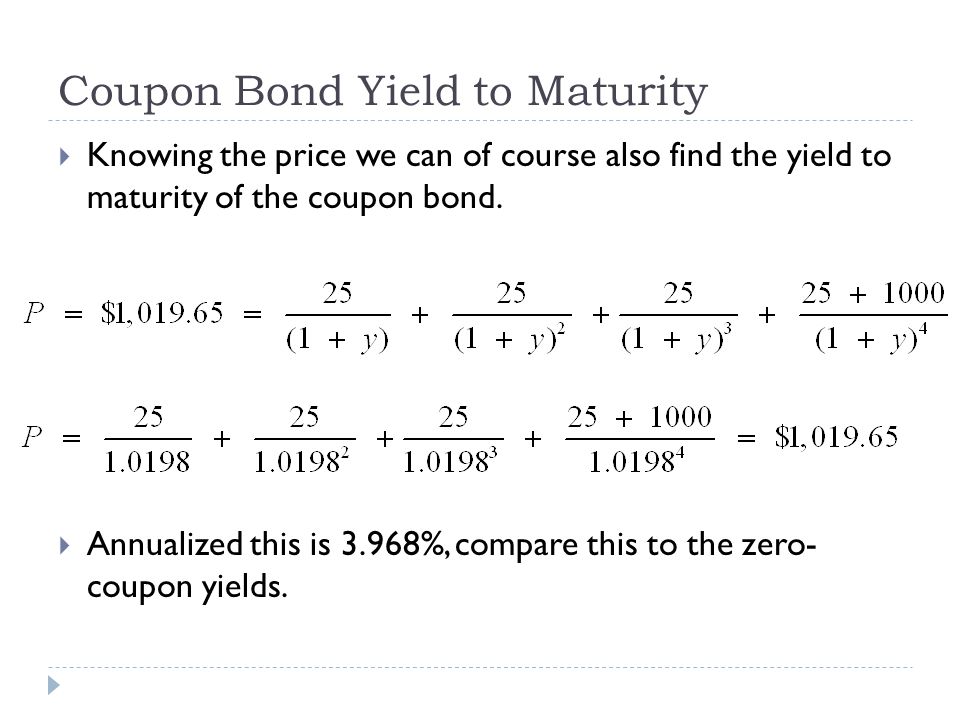

Yield to maturity coupon bond. How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Since it is possible to generate profit or loss by purchasing bonds below or above par, this yield calculation takes into account the effect of the purchase price on the total rate of return. If a... Bond Basics: Issue Size and Date, Maturity Value, Coupon - The Balance Coupon and Yield to Maturity The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ...

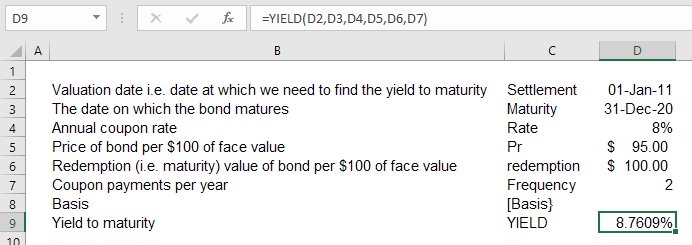

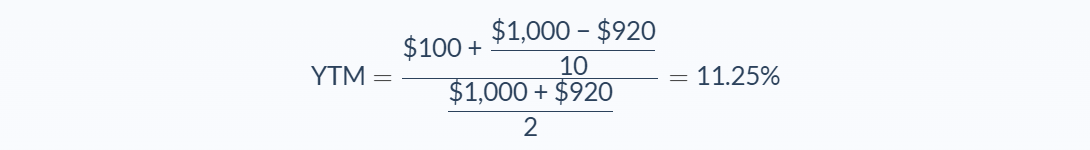

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... Excel yield to maturity - dpak.zsaluzia.info Type the formula "=Yield (B1,B2,B3,B4,B5,B6,B7)" into cell B8 and hit the "Enter" key. The result should be 0.0459--4.59 percent--which is the annual yield to maturity of this bond. References. Microsoft: Yield.. Jan 27, 2018 · YIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price ...

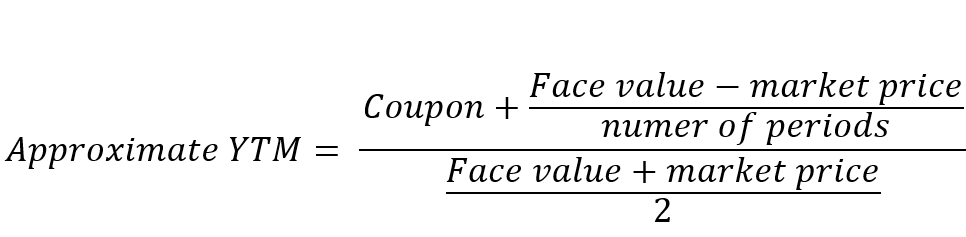

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Current yield - Wikipedia fluctuations in the market price of a bond prior to maturity. Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date.

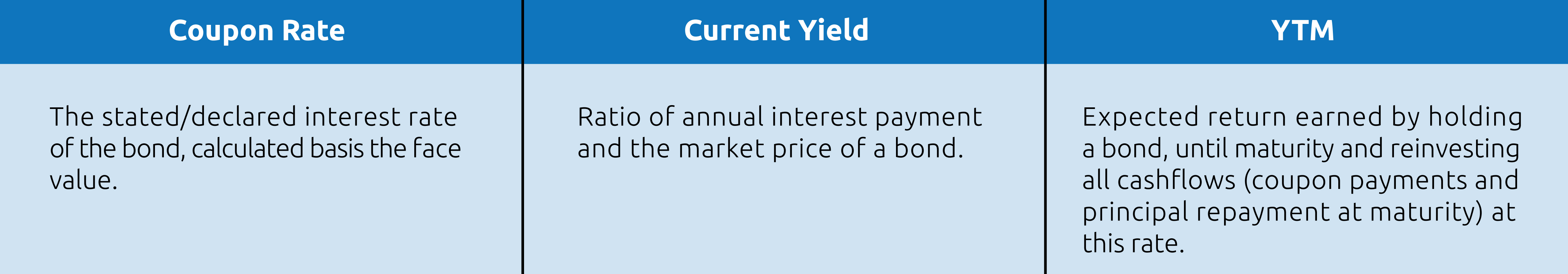

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Here's another example that clearly ...

Yield to Maturity : r/bonds - reddit.com Right now bonds are yielding above their issue interest rate, say a 2 year issued at 3% is now over 4% since the price has fallen to around $97-98. If I buy that bond at $97, I will get the coupon dividends until the time of maturity, plus at maturity I will get back the original $100 for a $3 profit, hence the higher calculated interest rate.

What is the yield to maturity for a 3 year bond with a 10% annual ... A bond's yield is equal to its coupon when it trades at par. For the risk of lending money to the bond issuer, investors anticipate receiving a return equivalent to the coupon. Therefore the yield of maturity will be 10% itself , Option C is the right answer.

Yield to maturity formula - yuzwo.lagrandemuraille93.fr The term yield to maturity is the total return determined for a bond when a specific bond is kept on hold until it matured. This type of bond is considered a long-term bond which is expressed as an annual rate. ... · The yield to maturity formula for a coupon bond: Bond Price = [ Coupon x (1 - (1 / (1 + YTM) n) / YTM) ] + [ Face Value x (1 ...

Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity Yield to Call

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

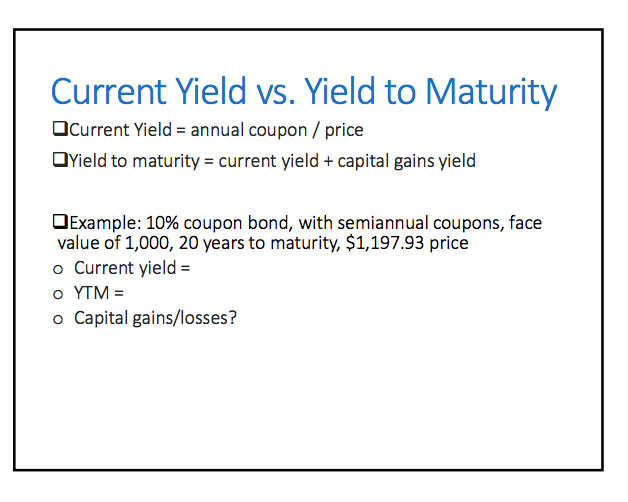

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Bonds are fixed-income products that, in most cases, return a regular coupon or interest payment to the investor. When an investor buys a bond intending to keep ...

Yield to Maturity (YTM): Formula and Bond Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. How to Calculate Yield to Maturity (YTM)

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. The coupon ...

Excel yield to maturity - khrqc.projet-plus.fr In rising interest rates, bond price will drop while in declining interest rates, bond price will rise. This spreadsheet also calculates the Yield to Maturity which is the interest rate that the bond holder receives if he holds the bond to maturity.The spreadsheet distinguishes between the Annual Percentage Rate and the Effective Annual Rate.

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands trading in the US market.

Bond maturity value calculator - qbydu.zsaluzia.info BOND CALCULATOR . This calculator is designed to help you calculate bond prices and yields. Simply enter 4 of the 5 values for your bond then click the relevant button to calculate the missing value . Click here to try our other Investment Calculators . Bond Price Field - The Price of the bond is displayed or entered in this field.

Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics. When a bond is issued, the issuing ...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

:max_bytes(150000):strip_icc()/YTM-356ce239fec6426696be4b7e3c58c5aa.jpg)

Post a Comment for "41 yield to maturity coupon bond"