43 coupon paying bond formula

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Bond Yield Formula = Annual Coupon Payment / Bond Price Bond Prices and Bond Yield have an inverse relationship When bond price increases, bond yield decreases. When bond price decreases, bond yield increases. You are free to use this image on your website, templates, etc, Please provide us with an attribution link Bond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

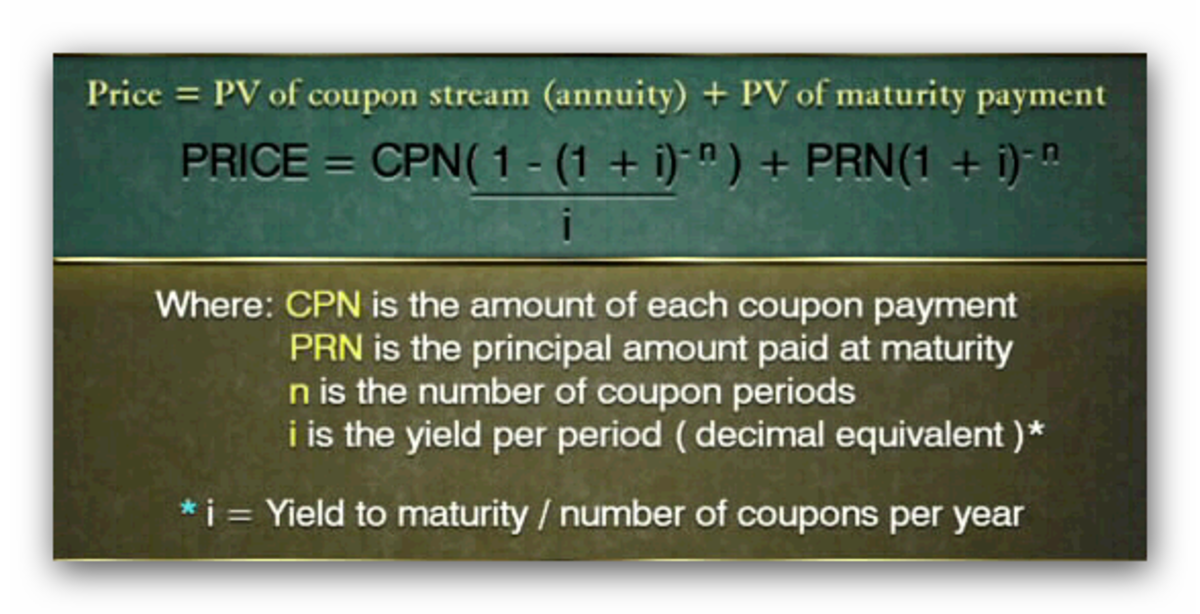

Bond Pricing Formula | How to Calculate Bond Price? | Examples The coupon payment during a period is calculated by multiplying the coupon rate and the par value and then dividing the result by the frequency of the coupon payments in a year. The coupon payment is denoted by C. C = Coupon rate * F / No. of coupon payments in a year

Coupon paying bond formula

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

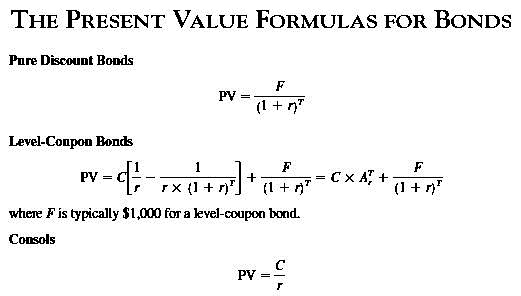

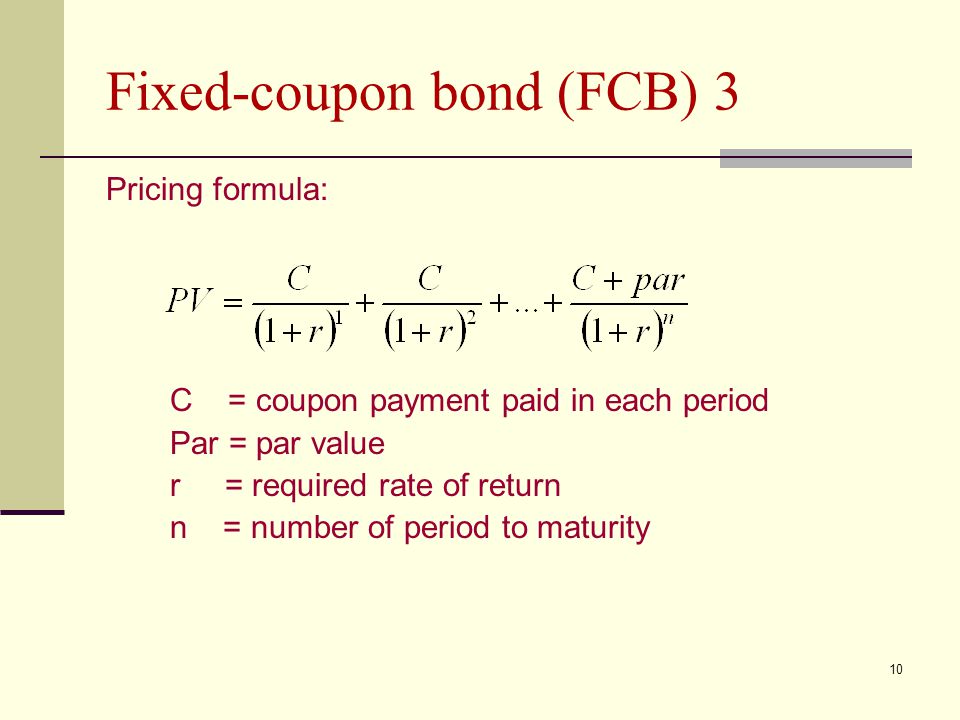

Coupon paying bond formula. Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

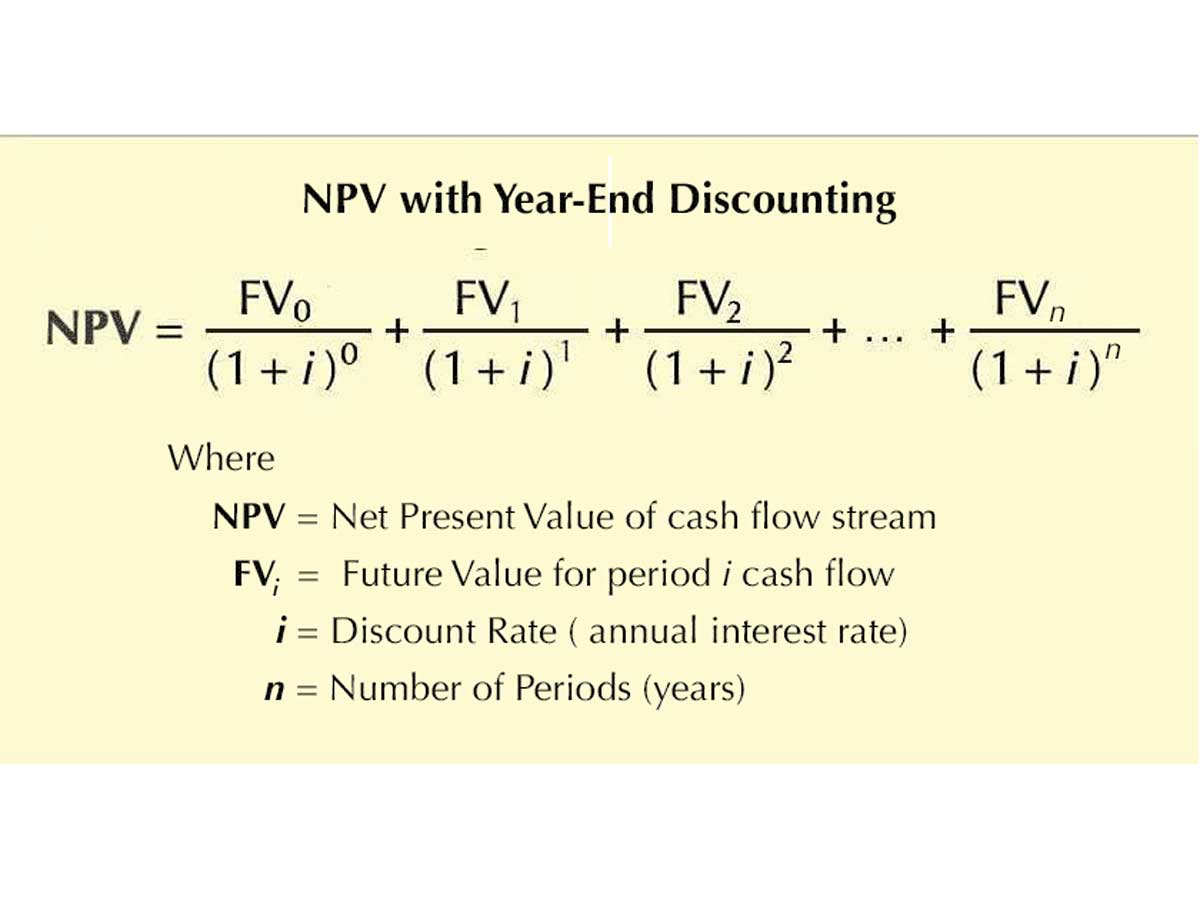

Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Amortization of Bond Discount: Definition, Calculation, and ... Explanation of Amortization of Bond Discounts. A business normally issues bonds when they require a source of long-term cash funding. When organizations issue bonds, investors hardly ever pay the face value of the bonds issued, in the case where the coupon rate (i.e. stated interest rate) on the bonds is less than the market interest rate. Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% annually with a maturity date in 20 years and a discount rate of 4%. The coupon is paid semi-annually: Jan. 1 ... Annualized Rate of Return Formula | Calculator | Example ... Let us take an example of an investor who purchased a coupon paying a $1,000 bond for $990 on January 1, 2005. The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment. Coupon Rate Structure of Bonds — Valuation Academy The zero-coupon bonds are sold at a substantial discount to par value. 3) Floating Rate Bonds have coupon rates that vary based on market interest rate or specific index (we call it reference rate) over the life of the bonds. The common formula to calculate the coupon rate is: new coupon rate = reference rate ± quoted margin. Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond Formula. Zero-Coupon Bond YTM Example. YTM Over Time. ... Instead of paying coupons, z-bonds are typically issued at a discount in the market and then mature to their face value ...

Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the ...

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

What is the discount factor formula for a coupon paying bond? There are N coupon payments and t N denotes the maturity of the bond in years. Then the bond price is given by, B = ∑ n = 1 N I exp ( − r n t n) + F exp ( r N t N) by Aaron Brown MBA in Finance & Statistics (academic discipline), The University of Chicago Booth School of Business (Graduated 1982) Author has 16K answers and 46.2M answer views 5 y

Coupon Rate Formula | Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000 ...

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula

Calculate the Value of a Coupon Paying Bond - Finance Train Par Value = $1,000. Yield = 13% annual (13/2 =6.5% semi-annual) Coupon = 12% with semi-annual payment of $60. Maturity = 1 year. The value of the bond is calculated as follows: Note that the coupon is paid semi-annually, i.e., $60 per 6 months. The discounting is also done semi-annually. The general bond pricing formula for all bonds can be ...

Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia A corporate bond (quarterly coupon frequency) with a $1,000 face value and a fixed 6% coupon pays out $15 four times a year, also at the predetermined dates of interest payment. In fact, by ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 coupon paying bond formula"