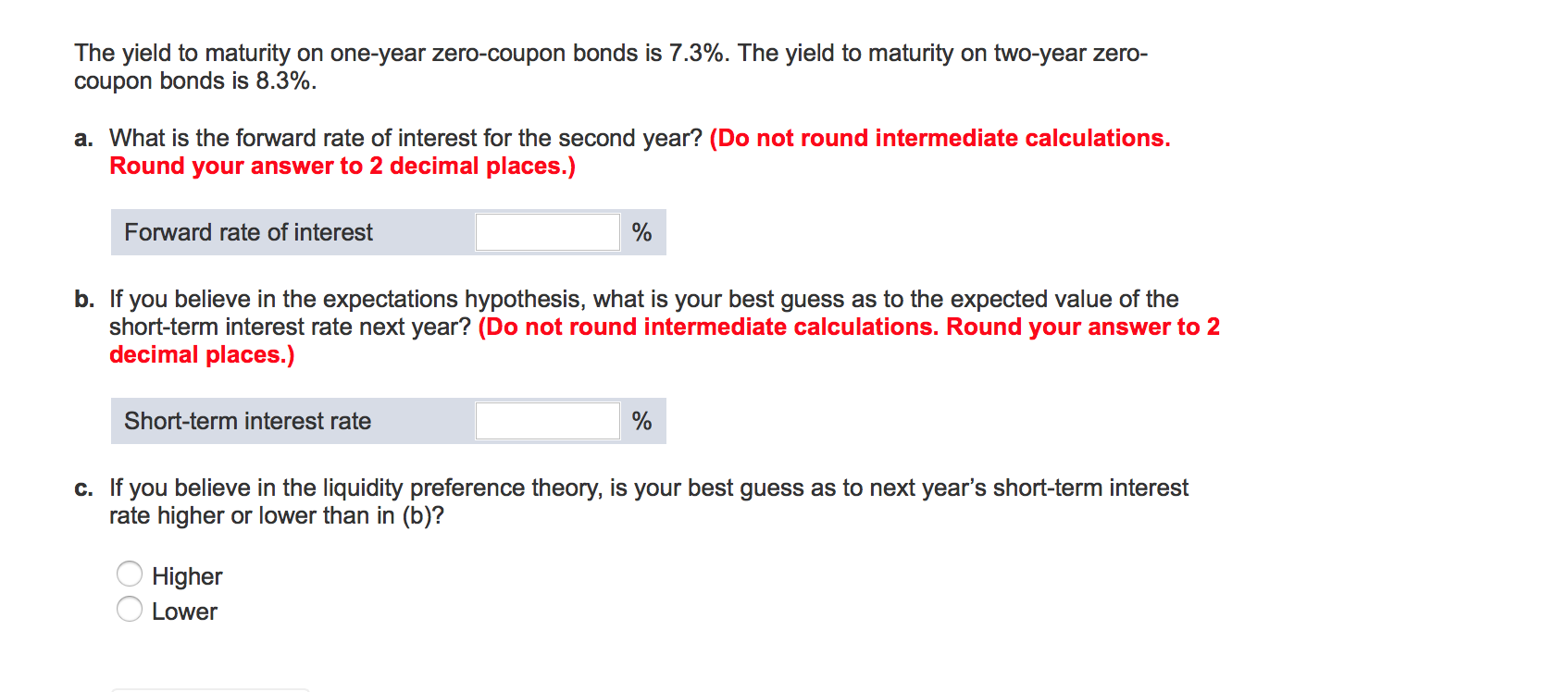

45 zero coupon bonds formula

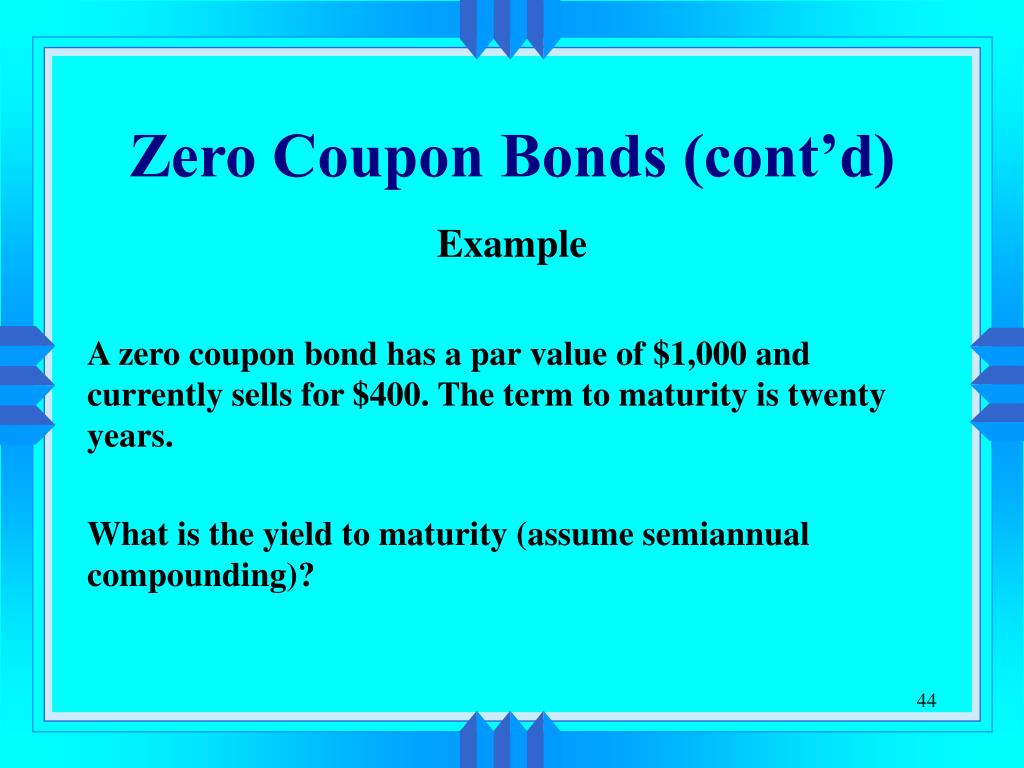

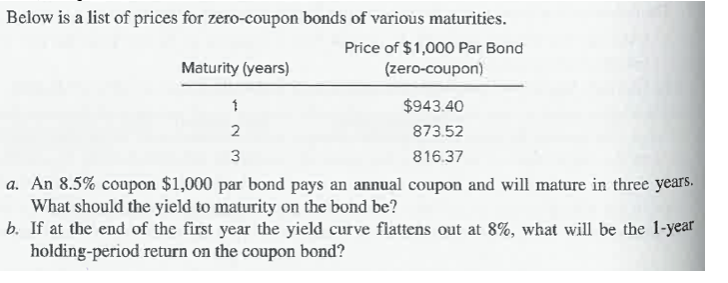

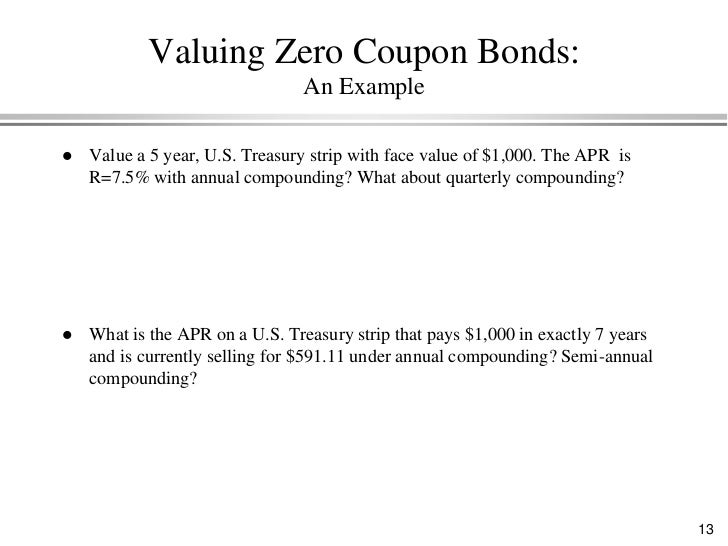

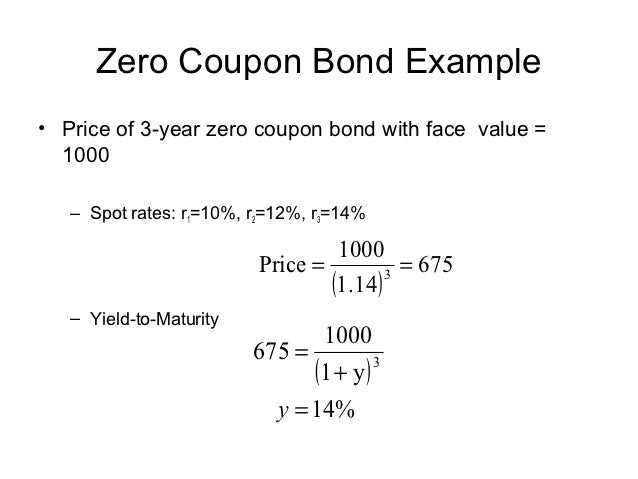

Zero-Coupon Bond: Definition, Formula, Example etc ... Price of bond = $1,000/ (1+.07)5 = $713.27 Hence, the price that Robi will pay for the bond today is $713.27. Example 2: Semi-annual Compounding Robi is intending to purchase a zero coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 7% compounded semi-annually. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero Coupon Bond Value Formula: How to Calculate Value of ... Example of price of a zero-coupon bond calculation Let's assume an investor wants to make 10% of return on a bond. The face value of the bond is $10,000. The bond is redeemed in 5 years. What price the investor would pay for this bond? M = $10,000 r = 10% n = 5 katex is not defined

Zero coupon bonds formula

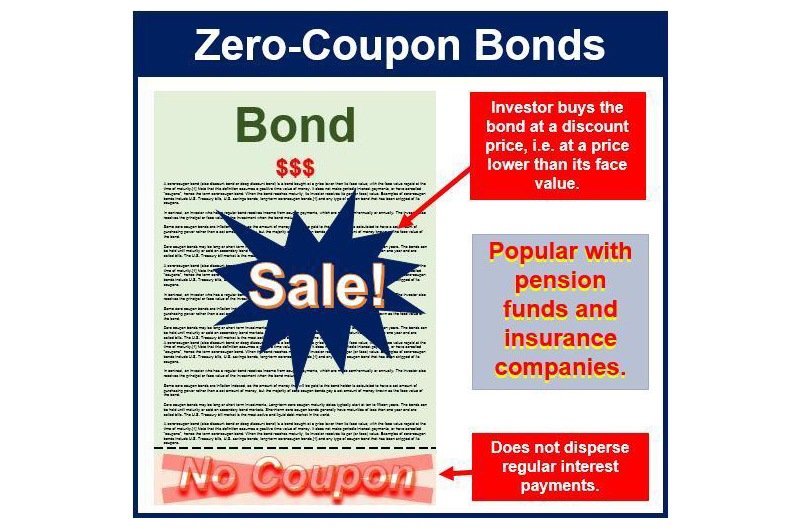

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at ... Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

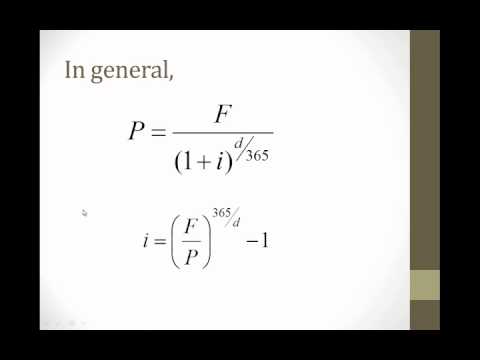

Zero coupon bonds formula. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero Coupon Bond (Definition, Formula, Examples, Calculations) These Bonds are initially sold at a price below the par value at a significant discount, and that’s why the name Pure Discount Bonds referred to above is also used for this Bonds. Since there are no intermediate cash flows associated with such Bonds, these types of bondsTypes Of BondsBonds refer to the debt instruments issued by governments or corp... Zero Coupon Bond Default Formulas - QuantWolf Default probability in terms of yield. p = 1 − α 1 − R α = 1 + y 0 T 360 1 + y 1 T 360 y 1 = yield of the bond y 0 = yield of the risk free bond T = number of days to maturity R = recovery rate, between 0 and 1. Zero Coupon Bond Yield: Formula, Considerations, and ... Mar 09, 2022 · The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of moneyTime Value of MoneyThe time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.. The time value o... Zero Coupon Bond | Definition, Formula & Examples - Video ... Zero-Coupon Bond Formula: Zero-coupon bonds are real-life applications of the time value of money concept which underlines that $100 now is worth more than $100 in the future. Bond Formula | How to Calculate a Bond | Examples with ... Bond Formula - Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula

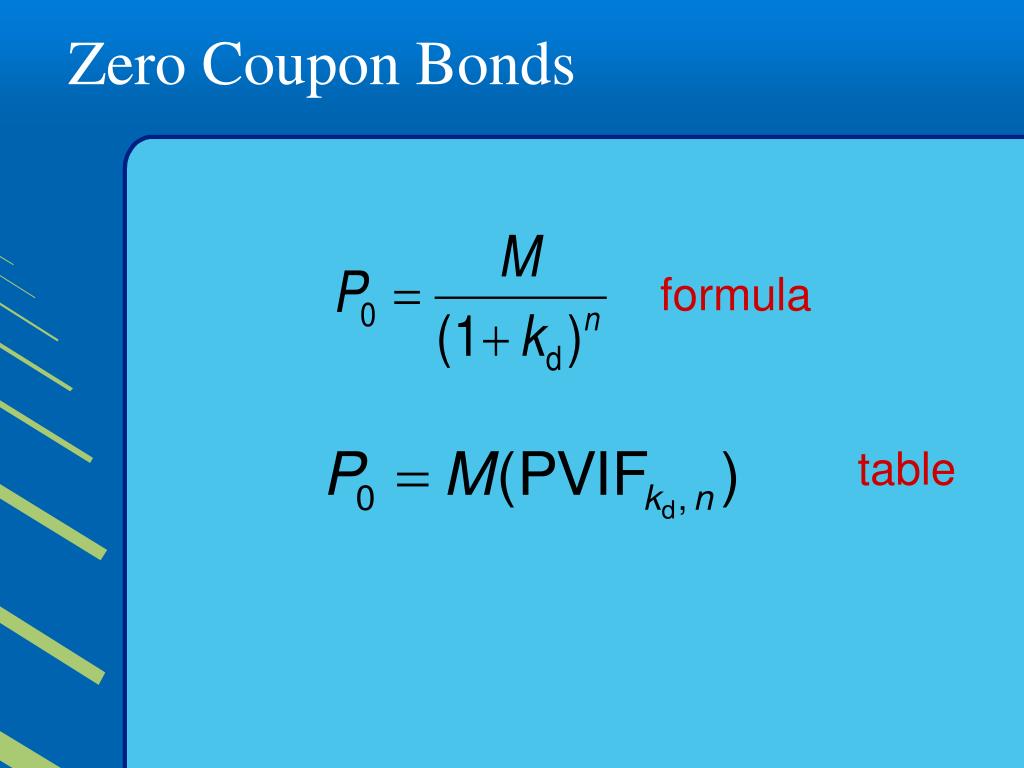

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates... Zero-Coupon Bond Value | Formula, Example, Analysis ... Zero-Coupon Bond Value Formula Price = \dfrac {M} { (1 + r)^ {n}} Price = (1+r)nM M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. Zero-Coupon Bonds: Definition, Formula, Example ... What are Zero-Coupon Bonds? A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is … Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

Zero Coupon Bond Calculator - What is the Market Price ... The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool.

Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Value Calculator - Find Formula, Example ... Zero Coupon Bond Value Calculator Formula. Let us go through the formula again after using it for example, this time clearly. This formula is the amount which the investor is willing to pay for a particular faced value bond, keeping into view a fixed required rate of return will be received at the time of maturity.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900 present value = $20,000 × $0.8900 present value = $17,800 Bond prices are often stated as a percentage of face value.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Coupon Bond Formula | How to Calculate the Price of Coupon ... What is Coupon Bond Formula? The term " coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more " refers to bonds that pay coupons which is a nominal percentage of the par value or ...

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at ...

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Post a Comment for "45 zero coupon bonds formula"